There’s a famous thought experiment in quantum physics: until you open the box, Schrödinger’s cat is both alive and not – two states at once. B2B buyers are the same.

They’re simultaneously in three states:

- Aware of and would consider your brand in their ‘mental shortlist’

- Aware of but wouldn’t consider your brand in their ‘mental shortlist’

- Not aware of your brand

And there’s no real way of knowing which.

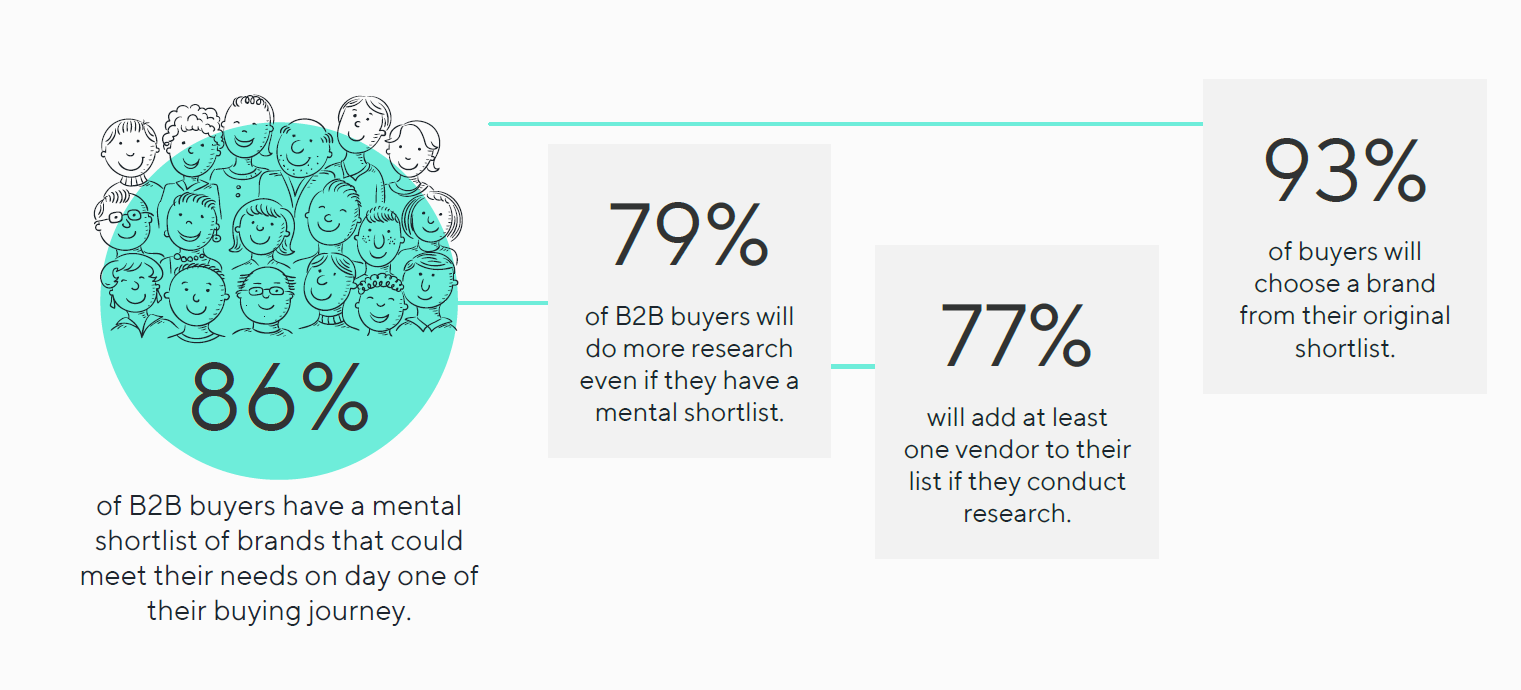

The important thing to note is that you need to ensure more of your addressable and serviceable market are in the ‘a’ camp. Aware of you and considering you in buying moments.

That’s the role of marketing. To get brands into that shortlist, and capture demand with more touchpoints throughout the self-serve buying stage.

Obsessing over direct attribution is like trying to measure a wave with a ruler. We need a broader instrument set – and a different mindset.

Marketers treat it like Around The Campaign in 80 Metrics – looking at all sorts of ‘signs’ and ‘signals’ and metrics that give them an idea. But for the most part that direction of travel is just a shortcut to Phileas Foggy objectives and misalignment. See what I did there.

Below is how I (and we at Cremarc) think about it, and how you can shift your attribution and planning to win more places on that mental shortlist. Because that really should be your primary marketing goal.

Most buyers are “out of market” – so brand memory does the heavy lifting

The uncomfortable truth: at any given time, the overwhelming majority of B2B customers aren’t in the buying stage. Ehrenberg‑Bass’s work with the LinkedIn B2B Institute popularised the 95:5 rule – only a small minority are in-market now. That changes the job of advertising from ‘get a lead today’ to ‘build memory structures so we’re recalled when need arises.’

Meanwhile, buyers increasingly self‑serve. Gartner has shown that when B2B buyers are considering a purchase, they spend only 17% of their time with potential suppliers (often split across several), and are more than halfway through their process before any “meaningful” contact with sales. In many categories, buying groups do 70% of their journey before talking to vendors at all.

What’s the implication of that?

If we aren’t already in memory – mentally available – we’re late to the party when a real opportunity lands. Building mental availability (and linking our brand to the situations that trigger buying) is the growth lever.

The shortlist is formed early – so become “easy to mind” at the trigger

How do we earn a place on ‘the shortlist’? Ehrenberg‑Bass’s Category Entry Points (CEPs) is the most useful, buyer‑centred tool I know: identify the situations (jobs, contexts, triggers) that open the category in people’s minds and methodically associate your brand with them. This is practical, measurable mental availability work.

Distinctiveness isn’t a “nice to have” – it’s a measurement and money issue

Two realities collide here:

Attention is scarce.

Most digital ads fail to pass the 2.5‑second attention‑memory threshold, the point at which a message starts to stick. Dr Karen Nelson‑Field’s team estimates ~85% of digital exposures don’t reach that bar.

Newer work with VCCP/Amplified shows 1.5 seconds can be enough for recall if your distinctive brand assets (DBAs) are visible instantly. In other words, short exposure isn’t wasted exposure – if you look unmistakably like you. That also means you need to hold consistency on a pedestal.

Boring is expensive.

The Cost of Dull study by System1 show brands may need 2–2.6× more media spend to achieve the same impact with dull ads versus interesting ones. Distinctive, emotionally engaging creative is not just art – it’s investment efficiency.

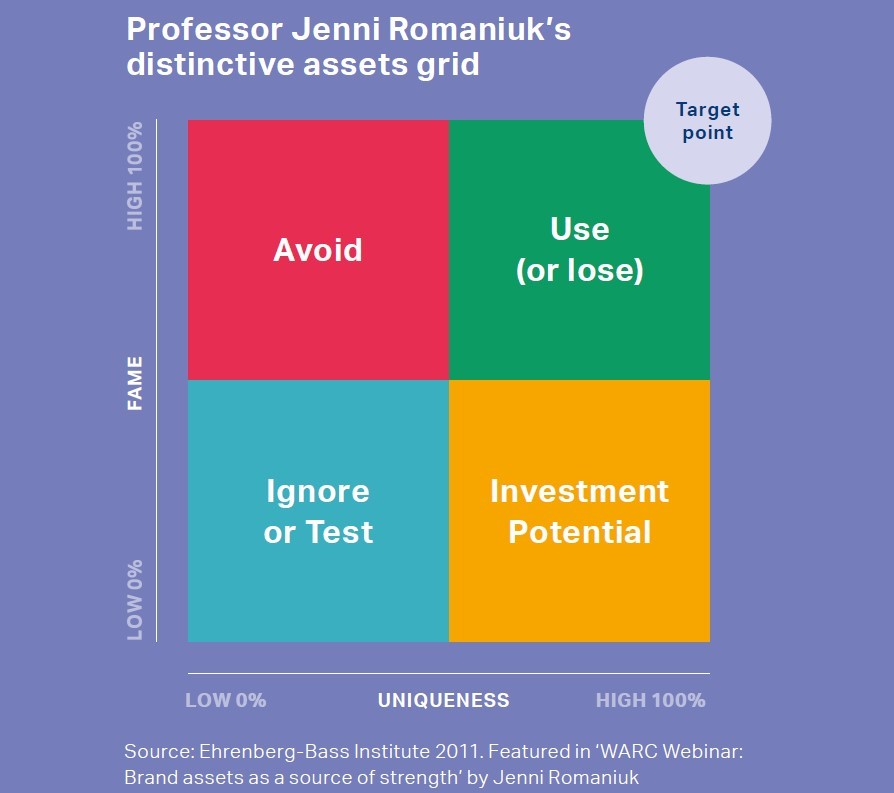

So, measure and manage distinctiveness like a balance‑sheet item: track which non‑name cues (colour, characters, sonic codes, shapes) are recognisable and unique and deploy them consistently across channels. Jenni Romaniuk literally wrote an entire book on this. Worth a read if you can find the time.

Why direct attribution keeps lying to you (and what to use instead)

Three forces make last‑click (and even many MTA dashboards) deeply misleading in B2B:

Non‑linear journeys.

Buying is messy loops of learning, consensus‑building and risk mitigation across 6–10 stakeholders – not a funnel. Time with vendors is a sliver. Any model that assumes linear progress will miscredit late‑stage touches.

Dark ‘social’.

A huge volume of actual persuasion happens in private channels – WhatsApp, Slack, email forwards, LinkedIn DMs, meeting rooms, water cooler chats – where measurement breaks. That traffic lands as “Direct,” severing the causal chain between your original effort and the eventual visit. (Estimates of private‑share’s share of all sharing often exceed 80%.)

MTA blind spots.

Browser privacy changes, cross‑device, impression effects (vs clicks), and offline influence mean multi‑touch attribution tools still under‑count upper‑funnel channels and creative. They’re useful – but incomplete without experiments and outside‑the‑stack signals.

Buyers are, in a very real sense, ‘unmeasurable’ at the granularity many dashboards promise. So we must move from precision theatre to decision‑useful measurement.

A holistic attribution stack you can run next quarter

You need to blend commercial outcomes with leading indicators – and here are some ways you can do that.

1. Commercial outcomes (lagging, definitive)

- Revenue, pipeline value, win rate, sales‑cycle length – owned by RevOps/Sales, reported monthly.

2. Leading indicators of mental demand

- Share of Search (SoS): your brand’s share of category searches. It’s a low‑cost, high‑frequency proxy for demand and a leading indicator of share of market in many categories. Track it weekly; manage to Excess SoS.

- CEP coverage & salience: run periodic buyer surveys to score how strongly your brand is linked to priority entry points. Use this to brief creative/media.

- Distinctive Asset fluency: measure which assets cue your brand (fame & uniqueness). Mandate their use in every execution, especially in short‑view environments.

- Attention quality: where possible, buy/report attention (active seconds) not just viewability; plan for placements that consistently exceed the memory threshold.

What to do on Monday

1. Map your Category Entry Points

Interview customers, sales, and lost deals. Prioritise the 2-5 buying situations you must own, then craft memory‑worthy messages and materials against each.

2. Audit your distinctive assets

Which cues are truly famous and unique? Standardise usage; make them unmissable in the first 1–2 seconds of every ad. Jenni Romaniuk’s chart is a really useful way to identify if your distinctive assets are truly distinctive or not.

3. Rebalance budgets

Ensure your marketing investment plan is built to fuel both future demand (reach, CEP‑linked brand creative) and demand capture (high‑intent search/site conversion). Brand building and sales activation are both performance marketing and you need to treat them as such.

4. Make your creative interesting

If your ads look like everyone else’s, you’re paying a dullness tax – 2–2.6x more to achieve the same effect. Push for ideas that entertain, use emotion, and intertwine your distinctive brand assets with category entry points.

The mindset shift

Marketing is for today and tomorrow. Yes, capture the 5% in‑market. But invest – consistently – in the 95% who aren’t, so you’re the brand they remember when the trigger hits. That means measuring what actually predicts tomorrow’s revenue: memory, attention, distinctiveness, and the category moments you can own.

Citations

- 95:5 rule & Mental/Physical Availability: Ehrenberg‑Bass Institute, LinkedIn B2B Institute

- Category Entry Points: Romaniuk (2022)

- Buyer journey data: Gartner, 6sense

- Cost of Dull: System1

- Attention-memory threshold: Amplified; VCCP/Amplified study.

- Distinctive Assets: Jenni Romaniuk, Ehrenberg‑Bass Institute

- Share of Search: IPA, Les Binet, brandgym